عرض العناصر حسب علامة : نصائح مهنية

الخميس, 16 سبتمبر 2021 10:23

كيف يمكنك تقديم المعلومات المالية بنجاح؟

من الضروري التفكير بشكل عملي عند تقديم البيانات والمعلومات المالية إذن كيف يمكنك تقديم المعلومات المالية بنجاح؟

نشر في

موضوعات متنوعة

موسومة تحت

الأربعاء, 15 سبتمبر 2021 20:55

كيف يمكن للزمالة الأكاديمية أن تعزز حياتك المهنية؟

معلومات إضافية

-

المحتوى بالإنجليزية

Nerissa Brown, Ph.D., had been interested in an academic fellowship with Office of the Chief Accountant at the SEC for years before she finally decided to submit her application in 2017.

At that time, she was a few years into a tenure-track position at the University of Delaware. She knew that the fellowship would mean commuting to Washington, D.C., being away from her 4-year-old daughter during the week, and spending nights and weekends on her ongoing research.

However, Brown decided there might never be an ideal time for a fellowship, so she might as well take the plunge. Rather than let logistical challenges stand in her way, she took a leap of faith, one that she says changed her life.

“I definitely see going to the SEC as changing the trajectory of my career,” said Brown, who completed her fellowship in 2018. The experience opened a new chapter for her: It helped motivate her to move into an associate professorship at the University of Illinois Urbana-Champaign, and a year later, a new role as academic director for its bachelor’s and master’s programs in accountancy.

Faculty might be interested in such fellowships but hesitant to pursue them, given that they often require suspending research, teaching, and other commitments. But Brown and other faculty who have taken fellowships say the time they spent immersed in the work of regulatory agencies such as the SEC and PCAOB paid off in their careers long after the programs were over.

“What you get out of it and what you can give back to the profession is way more than any time that you might lose working on your own portfolio of research,” Brown said. “That one year is like an investment in yourself.”

Below, they describe their experiences and what they gained from them.

Opening doors to new research

Andrew Kitto, Ph.D., an assistant professor of accounting at the University of Massachusetts Amherst, completed a PCAOB fellowship in 2019, after his first year teaching.

Kitto said he was drawn to the PCAOB because of the quality of data he would have access to.

“The fellowship has really allowed me to answer research questions that would have been much more difficult to investigate with only publicly available data,” Kitto said. “I think it's positively impacted the contribution of my research and has certainly helped my portfolio in a lot of meaningful ways.”

Zach Kowaleski, Ph.D., an assistant professor of accounting at the University of Notre Dame, was drawn to a PCAOB fellowship for similar reasons: It offered access to data on audit quality in the broker-dealer industry that isn’t publicly available, he said.

Brown said her time at the SEC also helped her advance her research by allowing easier access to the data and feedback from staff experts.

One of Brown’s projects was about using machine learning to detect what firms are discussing in their financial statements and using that information to predict fraud. While in her fellowship, Brown got to see how the technology works and talk with the staff that helped develop it, she said. One day at a meeting, she found herself sitting near a chief economist who helped build the algorithm.

“I had one of the most awesome conversations with him about that paper,” Brown said. “He actually had his old speeches that he wrote and showed me on his iPad and said, ‘You're doing the exact same thing that I was talking about in this speech.’”

Teaching with a new perspective

Kowaleski wasn’t sure what to expect when meeting the regulators of Washington, D.C. The fellowship gave him a better understanding of the institutions accountants operate within, which also makes him a better teacher, he said.

“As both a former auditor and PCAOB fellow, my experiences help me take both perspectives when speaking to students about how regulation shapes audits,” he said. “This helps students see beyond the textbook.”

Brown said that the time she spent immersed in day-to-day operations at the SEC, participating in task forces and consultations on complex topics, such as revenue and crypto-asset recognition, helped illuminate the real-life consequences of everything she teaches in the classroom.

On the first day of classes, she said, she now motivates her students by telling them that, with high-quality reporting and auditing, they can be the superheroes that will root out fraud and misbehavior in the capital markets, where so much is at stake.

Building networks and professional potential

All three professors say the connections they made through their fellowships have expanded their professional networks and their opportunities.

“The level of people you interact with is second to none,” Brown said. “You’re interacting with the chief accountant who monitors accounting across the U.S. and with individuals who are top partners in the Big Four, and you’re actually meeting the SEC chairman. That’s the level of interaction that you just don’t have as a regular faculty member.”

Brown has been invited back to the SEC to present her research, has hosted SEC experts to speak to accounting classes, and has even connected other professors at her university with experts at the SEC who can help with their questions.

Kitto said when he needs a sounding board or has a specific question related to his research, he can reach out to PCAOB staff members and they don’t hesitate to help.

“The network of former fellows has been a tremendous network to be able to tap into,” he said.

Advice for applying for a fellowship

Brown, Kitto, and Kowaleski offered a few suggestions for accounting colleagues who are considering applying for a fellowship:

Search for opportunities on websites for regulatory agencies and on job boards such as those hosted online by the Social Science Research Network (SSRN). If a fellowship does not exist for the area you’re interested in, consider writing to a relevant agency or firm and proposing one.

Don’t let obstacles such as distance dissuade you from applying, Brown said. Most agencies offer flexible work arrangements, as many employees commute from other states or work remotely some of the time. Options for remote work may be even better this year due to the pandemic, she said.

When applying, reach out to past fellows to ask about their experiences and what to expect, Kitto said.

Learn about the data that is collected by the agency you are applying to and read prior research that uses its data, Kowaleski said. Consider ideas that further the literature, but also overlap with the needs of regulators.

If you missed the deadline to apply for the next round, don’t let that discourage you, Kitto said. He missed an application deadline and it ended up being a “blessing in disguise,” as it gave him extra time to prepare his application for the following year. It allowed him to submit more well-researched and workable research proposals, which strengthened his application.

— Samiha Khanna is a freelance writ

نشر في

موضوعات متنوعة

الأربعاء, 15 سبتمبر 2021 20:52

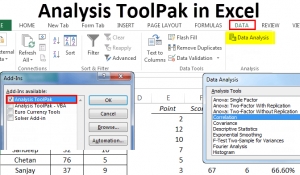

كيفية إضافة حزمة أدوات تحليل البيانات إلى Excel؟

نشر في

موضوعات متنوعة

موسومة تحت

الثلاثاء, 14 سبتمبر 2021 20:53

ابدأ بأتمتة العمليات الروبوتية

معلومات إضافية

-

المحتوى بالإنجليزية

February 9, 2021

What faculty should know about Alteryx

November 10, 2020

Bring the remote work trend into your accounting classroom

TOPICS

Accounting Education

Technology

Emerging Technologies

Accounting firms are using up-and-coming technologies with the potential to change the business landscape forever. One technology gaining interest is robotic process automation (RPA), a tool that computerizes mundane, repetitive tasks and completes them far faster than humans could do manually.

Greg Fritsky, practice director – intelligent automation solutions at EisnerAmper LLP, spends much of his time evaluating clients’ processes and introducing them to emerging technologies, including RPA, which is already used extensively by his firm. In one case, he said, RPA automated a client's process that previously took 160 human hours a month to achieve but now takes minutes to complete.

Other large public accounting firms have also adopted RPA. Deloitte and PwC, for instance, use RPA software internally and within clients' organizations.

RPA "is something people should be learning and teaching," said Fritsky, who is based in New Jersey. "Accounting is changing and it is changing fast, and this is a tool worth more than a conversation."

Accounting faculty have taken notice, and many now believe that students should learn RPA, or at the very least, be familiar with what the technology can do. Students adept at RPA get "special opportunities to work in special groups" within accounting firms, particularly the Big Four, said David Wood, Ph.D., an accounting professor at Brigham Young University (BYU) in Provo, Utah. "Firms want technical skills, and RPA right now is one that is in particular demand."

BYU's School of Accountancy advisory board, made up of representatives from large public accounting firms, "encouraged us to put RPA into the curriculum," he added.

Get to know RPA

By handling boring, repetitive tasks once conducted by people, RPA allows staff to work on tasks that require higher-level critical thinking and analysis. While there's always the fear that technology will replace humans, RPA frees up time for more challenging work for intelligent professionals, especially new recruits, who are often asked to carry out more humdrum duties.

RPA also eliminates manual errors and offers faster, more accurate outcomes. "RPA is absolutely going to change the role of accountants for the better," Fritsky said.

RPA tools like UiPath, Blue Prism, and Automation Anywhere also allow CPAs and accounting students with little to no coding knowledge to build bots, using a drag-and-drop process. A "bot,” a set of instructions one can build within an RPA software program, tells a computer system to perform various tasks, usually in response to certain triggers. For instance, bots can be created to reformat data or copy data from one computer system to another, Wood said.

RPA can also help with onboarding by sending automated yet sophisticated replies to job seekers, noted Asher Curtis, Ph.D., associate professor and faculty director of the Master of Professional Accounting Program at the University of Washington in Seattle.

Bots can be programmed to gather tax data from clients and move that data into spreadsheets, said Richard Walstra, CPA (inactive), DBA, assistant professor of accounting at Dominican University in River Forest, Ill.

And, as Fritsky explained, RPA can help with audits by extracting data from client systems and then performing tests on 100% of the population of that data, making it an invaluable, accurate tool.

Walstra, who learned about RPA on YouTube, noted that other data analytics programs, such as Alteryx, Tableau, and Power BI, analyze data, whereas RPA mechanizes a routine task. The term “robotic process automation” may sound futuristic, bringing up visions of robots, he said, but “it’s really just a machine function.”

So far only a handful of software producers sell RPA licenses. These companies, including UiPath and Blue Prism, often provide online tutorials, training, certifications, and free software to universities, making it fairly easy for faculty to get up to speed. EisnerAmper uses UiPath for its easy-to-learn aspect, Fritsky said, and the accounting departments at BYU, the University of Washington, and Dominican University chose UiPath as well for similar reasons.

Fritsky, Curtis, Wood, and Walstra offer the following advice for incorporating RPA into your classes:

Keep it simple. When Fritsky tries to explain RPA to people and goes "too technical,” they lose interest, he said. He advised starting with this clear-cut description: RPA is simply a tool that can eliminate manual activities currently performed by people. "

Students will find it easier to comprehend RPA if they have some foundational knowledge first, he said. "If the students are really good at Excel and have some advanced understanding, they will understand RPA a lot faster,” he said.

Dive in. The best way to get up to speed with RPA is to simply find the time to learn about it. Jump in with both feet," Wood said. "You've got to start somewhere and students will respect you for trying."

To get started, view tutorials on various vendor sites, or join sites such as UiPath's Academic Alliance, or watch videos online. Just start to explore some videos, and become familiar with the basic structure and flow of RPA, Walstra advised. This video, for example, offers a clear overview of RPA. Another provides a simple example of RPA. And this one, from KPMG, “shows a quick walk-through of a full business process," he said.

Review some RPA cases in the EY Academic Resource Center (EYARC), stated Curtis, who has helped lead an RPA workshop for faculty at the EYARC Colloquium.

Learn from more experienced faculty. Many accounting professors, such as Walstra, Curtis, and Wood, are ahead of the curve in teaching students about RPA, so learn from their expertise or the knowledge of other academics who are immersed in this technology. "Don't re-create the wheel," Wood said. "Talk with faculty who have done this before, by piggybacking on what they do."

نشر في

تكنولوجيا المعلومات

موسومة تحت

الثلاثاء, 14 سبتمبر 2021 20:53

اظهر بأفضل ما لديك خلال الدروس عبر الإنترنت

معلومات إضافية

-

المحتوى بالإنجليزية

November 10, 2020

Help students succeed with online testing

October 13, 2020

Variety is the spice of online learning

TOPICS

Accounting Education

Professional Development

Well-Being

The new semester offers a chance to start afresh, and one way to do so is by improving the way you look online, enhancing your reputation as a faculty member who can deftly navigate the digital world.

Here are a few simple tweaks that can help you appear at your best during online classes:

Choose the setting. When it comes to online classes, your appearance starts with where you’re sitting, so consider the background part of your image. Select a quiet area free of background noise and people coming and going, and think carefully about what people can see behind you, said Michael Freeby, a celebrity photographer and videographer. Instead of showcasing something potentially distracting or controversial, opt for a colorful painted wall or wallpaper. “Choose whatever backdrop you feel fits the image of yourself you would like to promote,” he said. If your university or department has a specific logo, you could custom-create a virtual background with the branding or logo as the backdrop, he suggested.

Make sure that your background doesn’t draw too much attention. “Uncluttered backgrounds allow students to focus,” said Scott Dell, CPA, DBA, an assistant professor of accounting at Francis Marion University in Florence, S.C.

Focus on lighting. Evaluate the lighting in the room where you’ll be on screen so that you don’t appear too light or dark, and use natural light to your advantage. “You don’t want any room with lighting that has orangey or yellow tones, and you also don’t want dim lighting as it will look significantly dimmer on camera,” Freeby said. While positioning yourself near windows with natural lighting generally works well, be “sure the light doesn’t shine directly into your eyes, making you squint,” advised Parker Geiger, chief executive of the Personal Branding Center, a professional coaching and consulting business based in Atlanta.

If your location has strong lighting or sunlight streaming in from behind “you can try to counteract that by setting your screen brightness really high to put more light on your face,” said Abir Syed, CPA (Canada), a Montreal-based e-commerce consultant with accounting services site UpCounting.

When appearing on camera, having lights in front of you is helpful. That’s why many people put a lamp in front of the laptop or buy a ring light, which can range from affordable to pricey and can stand alone or be attached to the computer or laptop, Freeby said.

Pay attention to your camera angle. The placement of the camera can also affect how you appear. Have the “camera at eye level,” Dell said. “People really don’t want to look up at you.”

For this reason, “make sure the camera hits you either at a completely parallel level to you, or from above you,” Freeby said. “Looking down to the camera is never a flattering angle, especially for video.”

Geiger suggested thinking of the screen as the face of your students. If you are using an external webcam, have the video call displayed on the monitor directly under your camera so that it appears that you’re looking at the participants instead of to the side, Syed said. “Having the camera close to the screen is ideal,” as it’ll appear to your students as though you’re looking at them, he said.

Consider your appearance. Even though your students may be in athleisure, be sure to “dress as if you were going to be face-to-face with others,” Geiger said. “Do not just dress professionally above the waistline and wear shorts and no shoes below.” Even if others will only see you from the waist up, how you’re dressed will affect how you feel and present yourself. “When fully dressed, you will project a confident, credible professional presence.” he said.

When it comes to clothing, avoid patterns, which can be “too much for the camera and can be distracting to the message,” Geiger said. Look for colors that complement your hair color and skin tone so that you can appear more striking on screen. Men should have shaved at least an hour before appearing on camera. “You do not want fresh cuts or irritation to show,” Geiger said. “Give the skin a chance to calm down.”

Try to “avoid glasses as they'll create glare and show what's on your screen,” Syed suggested.

Ultimately, Dell said, the key to looking better online is experie

نشر في

موضوعات متنوعة

الأربعاء, 28 سبتمبر 2022 14:59

حان الوقت للمديرين التنفيذيين أن يصعدوا إلى القمة

معلومات إضافية

-

المحتوى بالإنجليزية

Feeling the Heat: CEOs Who Ignore Climate Change Do So at Their Own Peril

KEVIN DANCEY | SEPTEMBER 2, 2021

On December 11, 1997, nearly 200 countries signed the Kyoto Protocol, extending the 1992 United Nations Framework Convention on Climate Change (UNFCCC). It was a modest attempt to commit state parties to combat global warming driven by human-made CO2 emissions.

Despite the intent, many countries did not meet their targets or withdrew from the agreement. Global emissions continued to grow, and climate change persisted—largely unabated.

Nearly a decade later, in 2015, all UN Member States adopted the 2030 Agenda for Sustainable Development, including the 17 Sustainable Development Goals (SDGs). Shortly after that, the Paris Agreement was signed on April 22, 2016. Again, almost 200 countries were signatories, committed to keeping the mean global temperature increase to well below 2°C and reducing emissions as soon as possible to reach net-zero in the second half of this century.

Nevertheless, this July, the International Energy Agency forecast that global emissions are about to surge to new highs. Meanwhile, a new report released in August by the Intergovernmental Panel on Climate Change (IPCC) states that climate change is “unequivocally” caused by humans and that temperatures may rise more than 1.5°C above pre-industrial levels by 2050, if not sooner, even in a best-case scenario of deep cuts in greenhouse gas emissions.

The question is: Will we heed this last-ditch warning with the societal, economic, and political fervor it demands even when so many prior attempts have fallen flat? I believe we will, and here’s why.

A New Point in History

Addressing climate change is a mammoth undertaking. It requires action from all stakeholders, not just governments. That was why the Kyoto Protocol failed. Governments were committed to various degrees, but most businesses, consumers, and citizens were not. This time they are.

Consider CEOs who are assessing the current landscape as they think about their organizations’ go-forward strategies. They don’t know how the world will unfold, but what they do know is that they must make choices so that regardless of what happens, they are positioned to succeed.

Historically, that success has been focused on investors and regulators and, of course, consumers. Today, however, companies are aware of larger sustainability forces at play. At the macro level, governments and regulators are debating action and public opinion is evolving. But only when these issues affect companies at the micro, organizational level, will sustainability be more than just another issue on the horizon, and that moment is happening now.

Three Key Factors Seizing the Attention of Every CEO:

Market share and consumers

This generation of consumers is different. An organization’s position on sustainability directly affects the market for the organization’s products and services. Providing low- or zero-carbon products and solutions is a clear competitive advantage, and commerce is reorganizing around new expectations. When I was growing up, for instance, labeling on packages was nearly non-existent. Today, we are advised of calorie, fat, sodium, and sugar content as a standard practice. In the near future, these labels will include carbon content as well, and CEOs must be ready for that inevitability.

Attracting capital

Investors are increasingly demanding more and better sustainability information. But the sustainability issues are deeper and more fundamental than just better reporting. Investors are now undertaking both negative Environmental Social and Governance (ESG) screening (e.g., excluding certain industries from an investment portfolio) or positive screening (where the scope is restricted to highly rated ESG companies). We know availability (supply) affects cost, and ignoring sustainability will only increase the organization’s cost of capital. Research proves that companies reporting on sustainability information and receiving assurance on it see both lower costs of capital and less capital constraint.

Attracting and retaining talent

Upcoming generations make career choices based on the sustainability approach of an organization. In fact, the Cone Communications Millennial Employee Study found that 64% of Millennials won’t take a job if their employer doesn’t have a strong CSR policy. A study by WeSpire found that Gen-Z is, “The first generation to prioritize purpose over salary.” No CEO can achieve their company’s mission without a pipeline of talent to support it. There is no doubt that incorporating sustainability at the organization’s core increases the likelihood of attracting today’s best talent.

This Time It’s Different

The mandate for CEOs is pretty simple: Ignore sustainability at your own peril. It’s not enough for organizations to continue with humble sustainability initiatives; we need far-reaching and urgent action to adequately respond to the severity of the threat posed by climate change. As businesses embrace the outsized influence they have to impart positive change within society, sustainability strategies must be built into core business models—not only for the good of organizations that wish to remain profitable and innovative, but also for the people and the planet.

This operationalization of sustainable business practices at scale will be a major change management moment for all organizations and, as a result, a huge opportunity for professional accountants to use their skills and competencies to significantly contribute in many roles. IFAC, as the global voice of the accountancy profession representing more than 3 million professional accountants worldwide, believes accountants can:

Play a key role in establishing processes, systems and controls for identifying and measuring sustainability information and connecting it to existing financial information;

Support public policy decisions and Governments as they endeavor to comply with their Paris Agreement targets;

Provide a range of advisory services to help clients become aware of these changes and opportunities, as well as providing assurance on new reporting obligations.

This time is different because all stakeholders are engaged. This is not a top-down government and regulator-driven initiative. With businesses and their stakeholders engaged, sustainability goals and climate action have the support they need to succeed.

نشر في

محاسبة و مراجعة

موسومة تحت

الإثنين, 13 سبتمبر 2021 20:22

3 مفاتيح تقنية لتمكين المحاسبين

معلومات إضافية

-

المحتوى بالإنجليزية

3 tech keys for empowering accountants

By Clayton Weir

September 10, 2021 10:43 AM

Facebook

Twitter

LinkedIn

Email

Show more sharing options

Much like every business vertical, accounting has seen its fair share of disruption as a result of the COVID-19 pandemic. And although digital transformation efforts have pushed innovation forward in many industries, accountants, by and large, unfortunately have to deal with fractured processes and outdated tools from pre-pandemic times. Not only do accountants have to tackle daily tasks with antiquated technology, but they have to find ways to make this tech meet the modern demands of today’s financial industry. And as the world around them continues to evolve and modernize, accountants are understandably struggling to keep up.

With that in mind, it is time for banks to allocate more attention and resources toward revamping their accounting infrastructure. Here are a few areas in particular that they need to focus on in order to make this happen.

Cloud migration

technology-and-telecom.jpgWith the number of tools that accountants are forced to deal with on a daily basis, remote work is a nightmare for those who are still forced to work with on-premise infrastructure. Moreover, given a significant portion of the financial industry still relies heavily on this “traditional” technology, on-premise is one of the foremost hurdles that is holding accountants back today. That said, the fix is quite simple: adopt the cloud.

By leveraging a cloud-based infrastructure, businesses can immediately boost the efficiency of their accounting teams by giving them easy, instant access to the data and solutions they need from anywhere. Additionally, it can also make onboarding new tools and processes far less painstaking than doing so with on-premise legacy systems.

Embrace automation

With CFOs and accounting teams now expected to participate more fully in business strategy and other non-finance tasks, the amount of time these teams have to engage in manual tasks continues to shrink. And as such, calls for greater automation within finance departments continue to grow.

According to a guide produced by Sage, 93% of finance workers say they would be happy to have tech do their daily accounting tasks. In addition, as budgets remain tight and workforces are continuously expected to do more with less, empowering accounting teams with automation will be pivotal to business efficiency and overall success.

Choose fintechs wisely

No two finance departments are exactly the same. So it is imperative that businesses take a step back and consider their needs properly before adopting tools and processes. Sure, a tool might seem to make sense on the surface, but what if it actually complicates things or makes tasks more challenging? All too often businesses jump into the fintech pool without fully understanding what their needs are and what they need to solve them.

Accountants have incredibly full plates to begin with. And without the support infrastructure and tools they need to juggle these tasks, it is virtually impossible for them to keep up with modern demands. Therefore, businesses need to work in close consultation with finance teams to identify their most pressing needs and find the solutions that are best tailored to them. Granted, with a global remote workforce, this may seem like a daunting prospect. By getting all of their ducks in a row early, not only will businesses be able to make the onboarding process far easier for their accounting teams, but they will also save valuable time and money down the road.

Accountants are integral to helping businesses achieve financial success. And with that, the time has come for these teams to be supplied with the modern tools that their work deserves. Without it, accountants will continue to struggle to meet their full potential and will not be able to help businesses achieve the growth they are looking for.

نشر في

تكنولوجيا المعلومات

الأحد, 12 سبتمبر 2021 21:34

هل تعرف الخطوات الخمس لرسم خريطة مسيرتك المهنية؟

نشر في

موضوعات متنوعة

موسومة تحت

الأحد, 12 سبتمبر 2021 12:58

عزز التسويق عبر الإنترنت لشركتك

بينما تبنى تجار التجزئة والشركات التجارية الموجهة للمستهلكين التسويق عبر الإنترنت منذ سنوات، كانت الممارسات المحاسبية بطيئة في تبني استراتيجيات التسويق الرقمي

معلومات إضافية

-

المحتوى بالإنجليزية

Power up your firm’s online marketing

By Lee Frederiksen

April 02, 2021, 11:07 a.m. EDT

5 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

While retailers and consumer-oriented commercial businesses embraced online marketing years ago, accounting practices have been slow to adopt digital marketing strategies. The pandemic has hastened adoption, but for most firms the move to digital marketing remains more reactive than proactive. Many of the digital tools and techniques remain unfamiliar to senior firm management.

This issue has been compounded by decades of accounting marketing tradition rooted in the belief that new business is best developed through referrals. However, while referrals still happen, they are happening less frequently. Accounting services buyers are increasingly likely to research and conduct business online. If you want to gain their attention, you’re going to have to do it through a screen.

Fortunately, there are a number of online solutions, channels and approaches that are proven to help firms like yours effectively reach and engage target buyers. To develop your own online marketing strategy, you’ll need to focus on two fundamental lead-generating drivers: the online tools and the digital content that attract your target audience.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

Reaching new-business prospects: Online tools that work

Effective online marketing is underpinned by several web-based tools that attract prospects to the top of the sales funnel. Each of these can successfully drive lead generation if utilized correctly:

Lead-generating website: Let’s face it. Most accounting websites are not dynamic, compelling marketing tools. They’re often jargon-filled, self-serving promotional vehicles focused on telling site visitors how great the firm is. To become a lead-generating machine, your website must clearly convey that your firm understands your prospects’ problems and needs and can provide solutions to address them. By offering potential clients valuable, objective information, you’re demonstrating what it would be like to work with you.

Search engine optimization (SEO): The vast majority of business professionals use the web to research the services they need. However, they will not find you unless the web knows you’re there. To do that, you need to optimize the content on your website so search engines — and, consequently, prospects — can find you. This is referred to as organic search and is primarily driven by having useful, authoritative content available on your website. It helps if that content is original.

Pay-per-click (PPC) advertising: While organic search is one of the most valuable and effective tools for attracting prospects, PPC can help you buy your way onto search engine results pages. It’s typically less expensive than traditional space advertising because you only pay when someone clicks your link and you can track and analyze your results to help make your campaign even more effective.

Online networking: This is the activity that takes place on social media. So while specific social media platforms (such as LinkedIn or Twitter) may be the actual tool, it’s the networking that happens on it that really engages with prospects. While the style of interaction may vary greatly from Twitter to LinkedIn to Facebook, it’s still about making the right connections with the right people. Just as with traditional networking, your level of success will be directly proportional to the amount of time and attention you invest in it.

Digital content: The fuel that drives your marketing engines

None of the above tools will work without relevant content to attract your target audience. Your content can take many forms, but several are particularly effective at attracting leads to your website and other online platforms:

Industry research reports: These are excellent lead generators. They attract prospects with highly valuable information while building your visibility, credibility and brand value. It’s critical, though, to choose research topics that are of exceptional interest to your target audience. As an added bonus, research reports provide an outstanding opportunity to partner with an industry trade association or a noncompeting firm. This can help reduce your marketing cost and increase your credibility through the implied endorsement by the industry group.

Webinars: Just like traditional seminars, webinars should be educational in nature — individuals will want to attend because they think they will learn something new and valuable about their issues or priorities. Webinars are typically offered free of charge. The value they provide to you is the registration information you gather from attendees, as well as market intelligence based on their questions and feedback, all of which can help you focus your marketing efforts and develop future topics.

Marketing videos: Well-produced, educational videos are excellent marketing tools for accounting firms. They can attract and nurture leads by providing valuable information about subjects of interest and helpful explanations about complex accounting and financial topics. Videos are also ideal for showcasing the expertise and experience of various members of your team.

White papers and e-books: Both of these are long-form, in-depth informational tools that make attractive pay-per-click offers and website giveaways in return for filling out a registration form. A little target audience research can quickly generate a list of appropriate topics of value that will attract your best prospects and encourage them to engage with your firm. A resource section on your website filled with e-books and white papers covering a wide range of valuable topics will go a long way in building your firm’s reputation as an industry expert and leader.

Blogging and guest blogging: Blog posts are an excellent driver of leads to your website. Blog posts are a cornerstone of almost any SEO campaign, providing opportunities to publish and distribute keyword-focused content that will boost your search engine rankings and attract prospects to your website.

Guest blogging is a great way to broaden your reach. If you have great content, it’s worth pitching it to publications or blogs that feature guest posts. This type of “earned media” can give your search engine ranking a lift and funnel readers to your site when you target high-authority online publications.

If you don’t already have an online marketing strategy, now is definitely the time to develop one. Combining online and traditional marketing to create an effective, comprehensive marketing program is an outstanding way to build your firm’s visibility and generate significant growth.

نشر في

موضوعات متنوعة

الأحد, 12 سبتمبر 2021 13:00

أفضل استراتيجيات إدارة العملاء لشركات المحاسبة

كثيرًا ما نلاحظ أن مالكي شركات المحاسبة يهتمون كثيرًا بعملائهم. ومع ذلك، يعتقد العديد من الأفراد الذين يغيرون شركاتهم أنهم لم يتلقوا الرعاية المناسبة من محاسبهم السابق.

معلومات إضافية

-

المحتوى بالإنجليزية

Better client management strategies for accounting firms

By Jason Schow and Jason Blumer

March 09, 2021, 11:35 a.m. EST

6 Min Read

Facebook

Twitter

LinkedIn

Email

Show more sharing options

We frequently observe that accounting firm owners care a lot for their clients. Still, many individuals who change firms believe they didn’t receive the appropriate care from their previous accountant. There is a clear disconnect regarding the accounting professional’s intent.

This is a phenomenon that we directly experience with some new clients. They typically tell us that their last firm wasn’t proactive enough and didn’t provide the value they expected. Yet from interactions with hundreds of accounting professionals, we have seen firsthand that they generally care very much for the people they work with.

So how can the accounting profession provide clients with a high-value service that reflects the firm’s concern? The answer may be in the creation of an efficient client management strategy — an aspect that is often not given the proper attention as firms grow.

Managing Your Firm in a Post-COVID World

Think beyond the pandemic with exclusive resources to help you build a thriving virtual practice.

SPONSORED BY INTUIT ACCOUNTANTS

Client management is an essential aspect of leading and running a professional accounting firm efficiently and providing ongoing value to clients. Also, as your clients are the firm’s source of revenue, they are obviously central to your company’s sustainability and growth.

It is a good idea to manage each clients’ entire journey versus expecting them to decide how, when, and what they purchase from the firm.

A client management strategy has a model that each firm can follow to make sure they are providing the client care needed to keep their firm running and developing. Overlooking this ecosystem can impact resources and result in clients receiving a lower level of service.

There are three stages where client management is particularly important: onboarding, pricing, and more generally in your business model.

Client onboarding

This is the first step when you start working with a new client before they receive any services. Something that has stood out as good practice during this phase is to make sure the clients you take on are a good fit for the way you do business. This is key to building a sustainable firm that you and your staff enjoy.

The process of new client intake can be slowed down to a point where you can create a place for value judgments, where both you and the potential clients can decide to work together or not. When the sales process is slowed down like this, you can give comfort to the client while increasing the perceived value of your work.

Some aspects — or the entire process — can be virtualized, for example by using Zoom conferences and shared documents. It is now possible to operate a virtual firm, and with the current pandemic situation, it is even an encouraged practice.

The ultimate goal in the client-onboarding phase should be to align with the potential client, dive into real discovery of their needs, and prepare them to be priced.

Pricing

Pricing is the second phase and happens before the service begins. Determining value in pricing is generally a skill that takes time and practice to master. Here are some questions we suggest asking potential new clients to help define price:

Why are you looking for a new accountant? Why now?

What do you hope to achieve in working with our firm? What do you see in us that made you interested?

How will we know this is successful?

What has stopped your company from resolving this in the past? What might stop your company from achieving these results in the future?

What will your company look like in two years?

What keeps you up at night?

What gets you up in the morning?

What have you valued about past relationships with financial coaches or advisors?

If working with our firm requires more time from you, can you commit that time? What are you willing to say no to for our collaboration to be a success?

What are all the issues to be addressed?

Did we get it right? What did we not ask that we should have?

Here are some practical observations on different types of pricing:

Hourly billing lends itself to a faster, more commodity-based firm business model. Hourly billing takes no client assessment, no conversations as to what the client may value, and puts the client in control to let the firm know what to do. Hourly billing is the fastest form of running a firm, as it takes little time to bring new clients into the firm. Any client is welcome in a billing firm.

Fixed pricing applies a single price to a service that is offered by the firm. Note that this is different from value pricing, where only the client has a price. Firms that offer monthly packages are doing fixed pricing.

Value billing is another form of hourly billing, yet takes it one step further. When the bill is calculated, a value markup is applied if the client perceives higher value than when the services were started. This is a difficult model to operate within since the influence of value with a client begins at the outset of a relationship, not after the work has been completed.

Value pricing is the slowest form of a firm’s business model. In a value-pricing firm, there are essentially no prices for services. Only the clients have prices since all services can (and are) sold to them for different prices depending on what they value most.

Firms do not have to exclusively adopt one model of pricing or billing but can instead weigh their benefits and apply the different models to different client groups or to different divisions of a firm (in large organizations). For example, firms offering advisory services would lend themselves to value pricing done by the owners of the firm, while the accounting and tax recurring revenue of many firms is suitable for a fixed pricing model.

No matter which model of pricing is chosen in your client management strategy, value is the core component to help the client and firm align on the goals and payment of the service.

Business model

The business model is the final phase where service happens and is the team structure you use to deliver services.

The way you manage your company’s capacity is fundamental to your firm being able to create efficient profit. There are several pillars to capacity management:

Time and location: These are the more controllable aspects of capacity. A firm can request their team work a certain amount of time in locations that afford the greatest productivity and use of that capacity.

Mind and emotions: These elements are generally not controllable. These are simply what the humans working in the firm bring with them each day. They are not strategic at all, and you never know when issues may appear and prevent the professional from focusing on their work. Leaders of the firm should be able to identify any team inefficiencies if they want to create profit for their growth, investment, and distributions. Managing and strategically predicting capacity is the key to turning the right amount of revenue into efficient profit.

Project management: This is the management of the scope of your services, the assignment of work to the team members, and the management of related software products that this management resides in. Project management is the foundation of service and is how a firm owner knows what work is flowing through their firm and what is being managed properly.

This is a high-level overview of the client management journey, and we hope it helps as you navigate this topic. Client management is an important matter in any firm. Without a strong vision about what this means, both firm owners and clients will struggle. Tackling topics like client management sets a firm apart to provide immense value, which in turn justifies higher prices in the marketplace they serve.

نشر في

موضوعات متنوعة

موسومة تحت